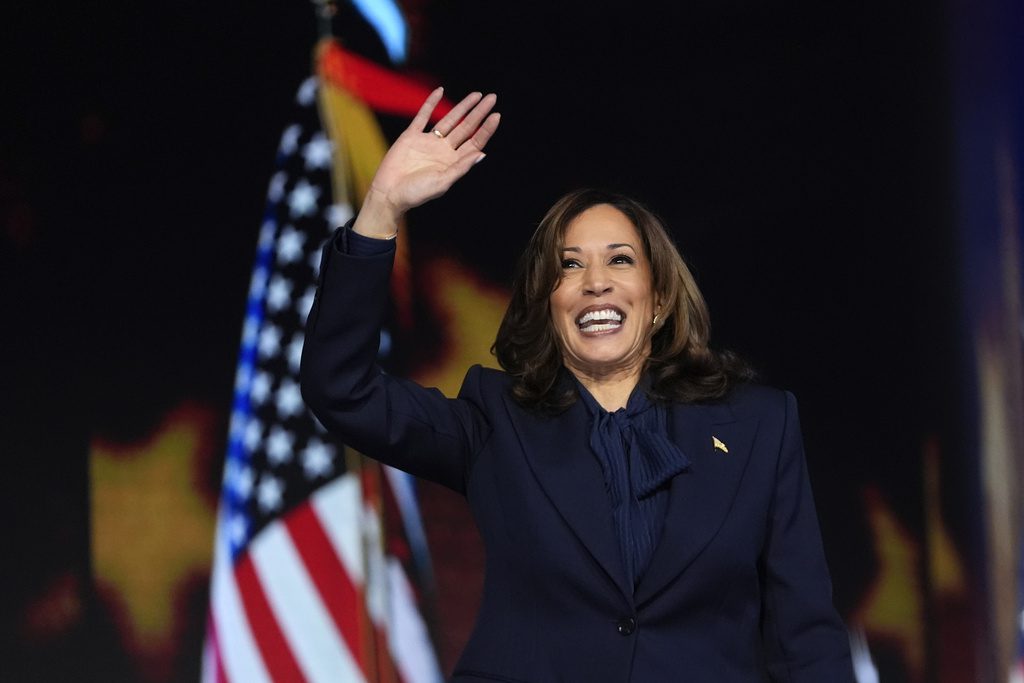

Democratic presidential nominee Vice President Kamala Harris speaks at the 2024 Democratic National Convention, Aug. 22, 2024 in Chicago. (AP Photo/Paul Sancya)

After years of a worsening housing crisis in Texas, Kamala Harris’ proposals seek to create three million homes by 2028, provide down payment assistance to first-time home buyers, and crack down on price fixing among corporate landlords.

Since launching her campaign, Democratic presidential nominee Kamala Harris has promised to focus on economic opportunity and rebuilding the middle class if elected president in November.

One way she’s aiming to do this is by addressing the current housing crisis in Texas and the United States.

Nationally, there is a shortage of more than seven million affordable homes for the 10.8 million-plus extremely low-income families in the US. Seventy percent of these families are severely cost-burdened, meaning they spend more than half of their income on rent. There’s also no state or county in the country where a renter working full-time at minimum wage can afford a two-bedroom apartment.

Additionally, mortgage rates are hovering above 6% and with steadily rising home prices and the lowest inventory of homes for sale in over a decade, the housing market is increasingly pricing out working and middle-class families.

In Sept. 2020, the median home sale price in Texas was $273,000. As of July 2024, that figure had risen to $354,300, a nearly 30% increase, according to Redfin. Renters are also paying more in the state: asking rents grew by more than 20% from $1,614 in March 2020 to $1,937 in Sept. 2024. These figures are in line with a national trend that’s shown rising home and rent prices since the beginning of the pandemic.

Here’s what Harris has proposed to address these issues:

Expanded tax credits and funding for first-time home buyers

Harris has promised to increase the available housing supply in the US by expanding the Low-Income Housing Tax Credit, which provides incentives for both state and local investment in housing.

Harris wants to create a $40 billion tax credit that would make building new housing more economically practical for builders. The goal is to encourage rapid building of affordable housing in order to close the gap between housing needed and housing currently available as well as support “innovative” methods of construction financing.

This funding would also make certain federal lands eligible to be repurposed for new housing developments.

To cut down on red tape and to bring down housing costs, Harris’ plan also calls for streamlining the permit approval and review process.

“In some places, it is too difficult to build, and it is driving prices up,” Harris said during a recent campaign event in North Carolina.

Collectively, these policy proposals seek to create three million homes by 2028.

If elected, the Harris-Walz campaign has also vowed to create a plan to provide lower-income first-time homebuyers with up to $25,000 in down payment support.

“We know a strong middle class has always been critical to America’s success. And building that middle class will be a defining goal of my presidency. This is personal for me. The middle class is where I come from,” Harris said in her speech at the Democratic National Convention (DNC) last month.

“We will end America’s housing shortage,” Harris added during her DNC address, a declaration that was met with thunderous applause from delegates.

These plans would need congressional approval, meaning if Republicans retain their House majority or win back control of the Senate, they could block Harris’ efforts to address the housing crisis.

Bringing down rent costs

Harris is also proposing two acts to address the rising cost of rent and lower tenants’ costs.

She has endorsed the Stop Predatory Investing Act, which would remove key tax benefits for housing investors who acquire a large number of single-family rental homes.

This proposal comes in light of Wall Street buying up entire neighborhood blocks and corporations purchasing large swaths of single-family homes. In fact, according to MetLife Investment Management, institutional investors may control 40% of US single-family rental homes by 2030.

The Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, on the other hand, seeks to crack down on rent-setting software that “enables price-fixing among corporate landlords.”

Harris’ proposal comes as this sort of price-fixing has become more and more common. Just last week, the Justice Department, along with the attorneys general of eight states, filed a civil antitrust lawsuit against RealPage Inc., a property management software company, for its “unlawful scheme to decrease competition among landlords in apartment pricing and to monopolize the market for commercial revenue management software that landlords use to price apartments.”

The complaint accuses the company of taking over the market for price-setting software, “effectively monopolizing it,” and ultimately helping landlords jack up prices on tenants.

According to a report from the Joint Center for Housing Studies at Harvard, a record 22.4 million American households now spend at least 30% of their income on rent.

Harris has also backed a proposal from President Biden, who in July called on Congress to pass a law that would withdraw tax credits from landlords who raise rent by more than 5% annually. If passed, the plan would apply to landlords with at least 50 units in their portfolio, meaning that overall, 20 million units nationwide would be affected, according to the White House.

That’s about half of all rentals in the United States.

The proposal was praised by housing advocates.

Shamus Roller, the executive director of the National Housing Law Project, called it a “historic” move that would “increase housing stability for tenants.”