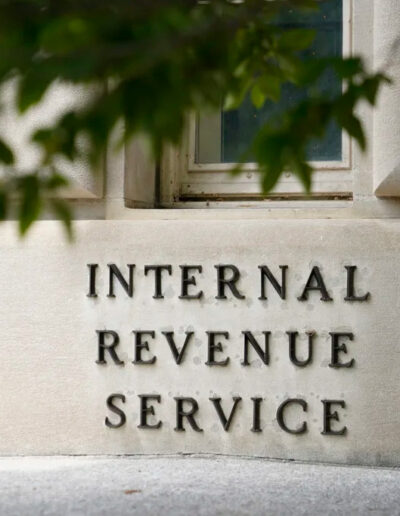

The Biden administration on Thursday announced its latest proposal for widespread student loan cancellation that could provide relief to millions of Americans, including those facing severe financial struggles.

This marks the administration’s second try at widespread student loan relief, following the Supreme Court’s decision last year striking down President Biden’s initial student loan cancellation plan.

In an effort to create a loan relief program that will avoid the same fate, Thursday’s proposal will narrow the relief provided by focusing on certain groups of borrowers. This time around, those with older loans or loans with large sums of interest, as well as those who face “financial hardship” are being targeted.

“College is meant to lead to a better life, but too many students end up struggling due to their student debt,” Under Secretary of Education James Kvaal said in a statement released Thursday. “The ideas we are outlining today will allow us to help struggling borrowers who are experiencing hardships in their lives, and they are part of President Biden’s overall plan to give breathing room to as many student loan borrowers as possible.”

The new proposal focuses on defining what exactly “financial hardship” means by outlining a set of factors that could identify struggling borrowers.

These include those with student loan balances and required payments that are “unreasonable” relative to their income as well as those with high-cost, unavoidable child care and health care expenses. Financial hardship can also be determined based on disability, age, and other debt obligations, and the proposed regulations state that “any other factors of hardship identified by the Secretary” may also be considered.

Borrowers who are highly likely to default in two years would be eligible for full and automatic relief under the proposal.

Borrowers also could get their entire remaining balance erased if they have been repaying their loans for at least 20 or 25 years, depending on the type of loan. The 20-year stipulation would apply to those who received the loan as an undergraduate student, for example.

Borrowers who have seen their loan balances grow larger due to snowballing interest would also be eligible for up to $10,000 or $20,000 in relief, depending on their income. People who earn up to $125,000 or couples who earn up to $250,000 could see up to $10,000 of their accrued interest erased. Individuals who make less than $125,000 or $250,000 as a couple could see their accrued interest reduced by up to $20,000.

This relief only applies to the amount of money that has piled up beyond the original loan amount, however; a borrower whose current balance is $7,000 higher than the original loan would get $7,000 forgiven, for example.

The administration said that it could not provide an estimate of how many people might be eligible for relief under the hardship proposal specifically.

When negotiators were first tasked with determining who would be eligible for relief through this new plan, they initially did not consider those experiencing financial hardship. After three rulemaking sessions and pressure from lawmakers including Sen. Elizabeth Warren (D-Mass.) and Rep. James Clyburn, (D-S.C.), however, they included this group.

“We are concerned that, without full consideration of cancellation targeted toward borrowers facing financial hardship, the rule will not provide adequate debt relief for the most vulnerable borrowers,” the lawmakers wrote in a letter to US Secretary of Education Miguel Cardona on Jan. 24.

The Education Department is scheduled to hold an additional rulemaking session on Feb. 22 and Feb. 23, where the negotiating committee will focus exclusively on financially-strapped borrowers.

Student loan relief advocates have praised the Education Department’s proposal.

Persis Yu, deputy executive director of the Student Borrower Protection Center (SBPC) said in a statement that the proposal would “drive debt relief to anyone who had to borrow for college and still struggles to stay afloat.”

“Upon enacting this proposal, federal policy will finally recognize what Americans from all walks of life have known for decades—too often, higher education does not deliver on its promise of economic mobility and financial stability, and borrowers and their families should not be sentenced to a lifetime of debt as a result,” she said. “The new hardship rule is a strong step in the right direction, creates an important safety valve to cancel debt when things don’t go according to plan, and provides millions of people with a second shot at the economic opportunity they were promised.”

Since the Supreme Court struck down President Biden’s initial plan last year, the Biden administration has approved $136.6 billion in relief for more than 3.7 million people.

This includes nearly $45.7 billion in debt relief for roughly 930,500 borrowers nationwide who are eligible for forgiveness through changes to Income Driven Repayment (IDR) plans and $56.7 billion in relief for 793,400 public servants through various forgiveness programs, including the Public Service Loan Forgiveness (PSLF) program.

More than 513,000 borrowers with permanent or total disabilities have also received debt relief. Finally, 1.3 million borrowers who were misled or defrauded by institutions, saw their institutions suddenly close, or who are covered by related court settlements have received relief.

Since Oct. 2021, 47,950 Texans have had $3.4 billion in student debt discharged via PSLF, based on the latest figures released in early Dec. 2023.

Additionally, over 71,000 Texans have been identified for debt relief due to changes to the IDR plans. That data is also as of early December.

To date, the Biden administration has granted more student debt relief than any other administration.