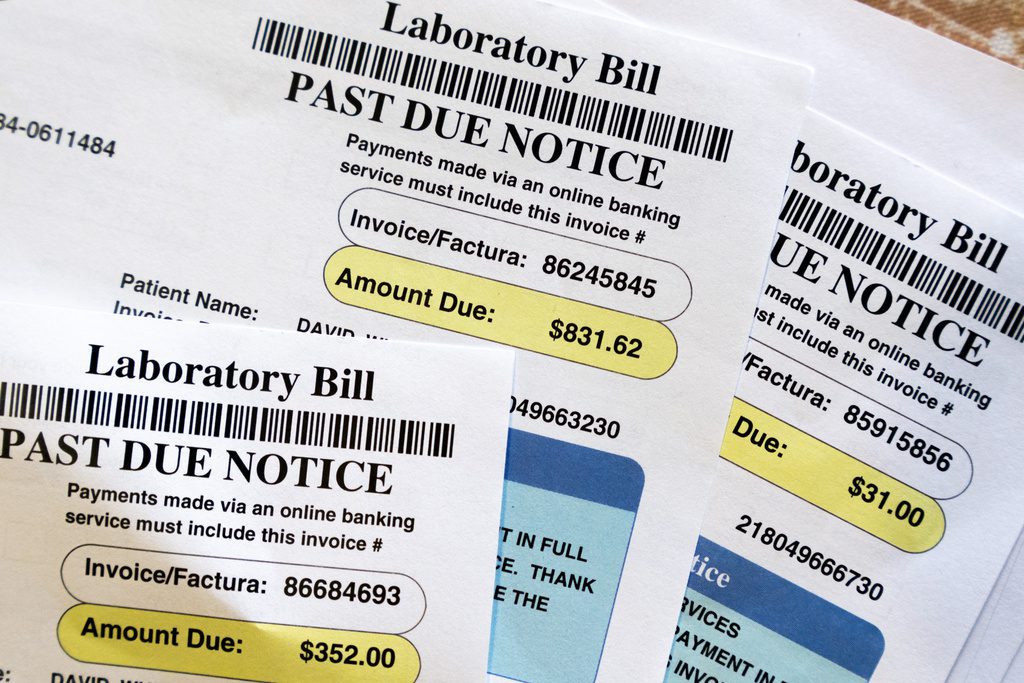

Roughly 15 million Americans have medical debt on their credit reports. The new rule means that debt will no longer be able to depress their credit scores and make it more difficult for them to get a job, rent an apartment, or secure a mortgage or car loan. (AP Photo/Jacquelyn Martin)

Roughly 15 million Americans have medical debt on their credit reports. The new rule means that debt will no longer be able to depress their credit scores and make it more difficult for them to get a job, rent an apartment, or secure a mortgage or car loan.

The Biden administration announced on Tuesday that it’s going through with its proposed rule to ban medical debt from credit reports—a sweeping change that will help tens of millions of Americans.

The new regulation will ban credit reporting agencies from considering medical debt when calculating credit scores and bar lenders from using medical debt to determine loan eligibility. This means that the debt will no longer be able to depress borrowers’ scores and therefore make it more difficult for them to get a job, rent an apartment, or secure a mortgage or car loan.

“This is going to be an enormous relief for so many people battling bills when it comes to medical visits,” Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra said Tuesday on ABC’s “Good Morning America.”

According to a study released in April by the CFPB, roughly 15 million Americans have medical debt on their credit reports. Another recent analysis from the Peterson Center on Healthcare and KFF put the total number of Americans with medical debt at 20 million, including an estimated 2.3 million Texans.

The rule comes less than five months before Election Day—when President Biden will face off against former president Donald Trump—and is the latest Biden administration effort to lower costs for Americans.

New ABC News/Ipsos polling found that the economy and inflation are among the most important issues to American voters going into November’s election.

The rule announced Tuesday will now undergo weeks of public comment, and likely would not go into effect until 2025, meaning that the election will likely determine whether the measures are implemented. During Trump’s time in office, he did not seek to remove medical debt from consumers’ credit reports and reports on his proposed economic agenda primarily center around plans to extend his 2017 tax cuts for corporations and the wealthy.

Building on past progress

Following pressure from the federal government, the three major credit rating agencies, Equifax, Experian, and TransUnion in 2022 began removing small, unpaid medical bills and debts that were less than a year old from consumer credit reports. This has led to a significant drop in total medical debt nationwide, according to a 2023 analysis from the nonprofit Urban Institute.

As of August 2023, 5% of American adults with a credit report had a medical debt on their report, down from almost 14% from two years prior. The analysis also found that Americans with medical debt on their credit report saw their VantageScore—a credit score jointly developed by the three major credit bureaus to predict how likely you are to repay borrowed money— improve from an average of 585 to 615, which moved many of these consumers out of a subprime category. Subprime borrowers usually have higher interest rates on loans and credit cards, if they’re able to borrow money at all.

Opposition to the new rule

Hospital leaders and representatives of the debt collection industry oppose the rule and claim it may have unintended consequences, such as more hospitals and physicians possibly having to require upfront payment before delivering care. These groups have also claimed that looser credit requirements could also make it easier for consumers to get loans they may never pay back.

A California dermatologist has also sued the three major credit rating agencies, claiming that if medical debts don’t appear on credit reports, patients will have less of an incentive to pay their bills, which could potentially cost physicians billions of dollars. That case is still pending in federal court.

Other Democrats are attempting to tackle the issue of medical debt, as well. Last month, Sen. Bernie Sanders (I-Vt.) and lawmakers proposed legislation that would not only eliminate all existing medical debt, but also impose restrictions to limit future medical debt, for example.